Jersey tax system - taxation of Jersey companies and individuals: VAT, income tax and capital gains. Tax treaties of Jersey. | GSL

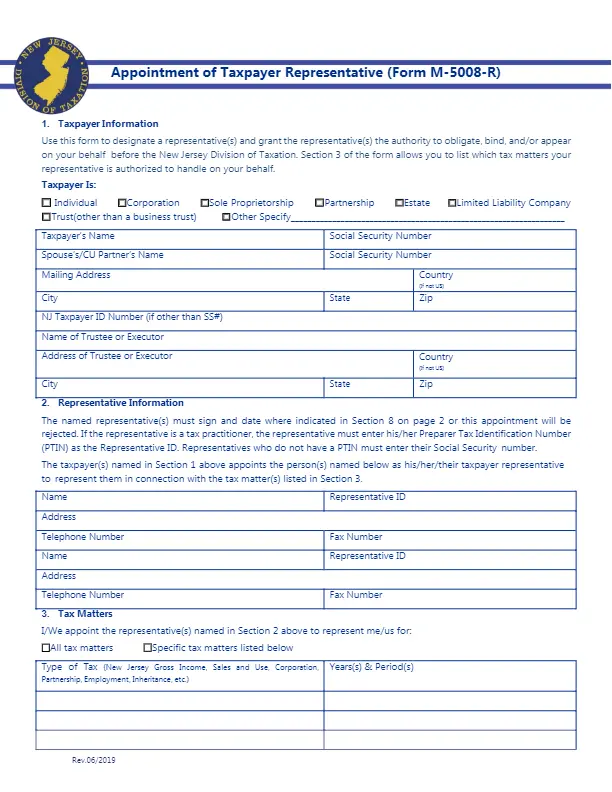

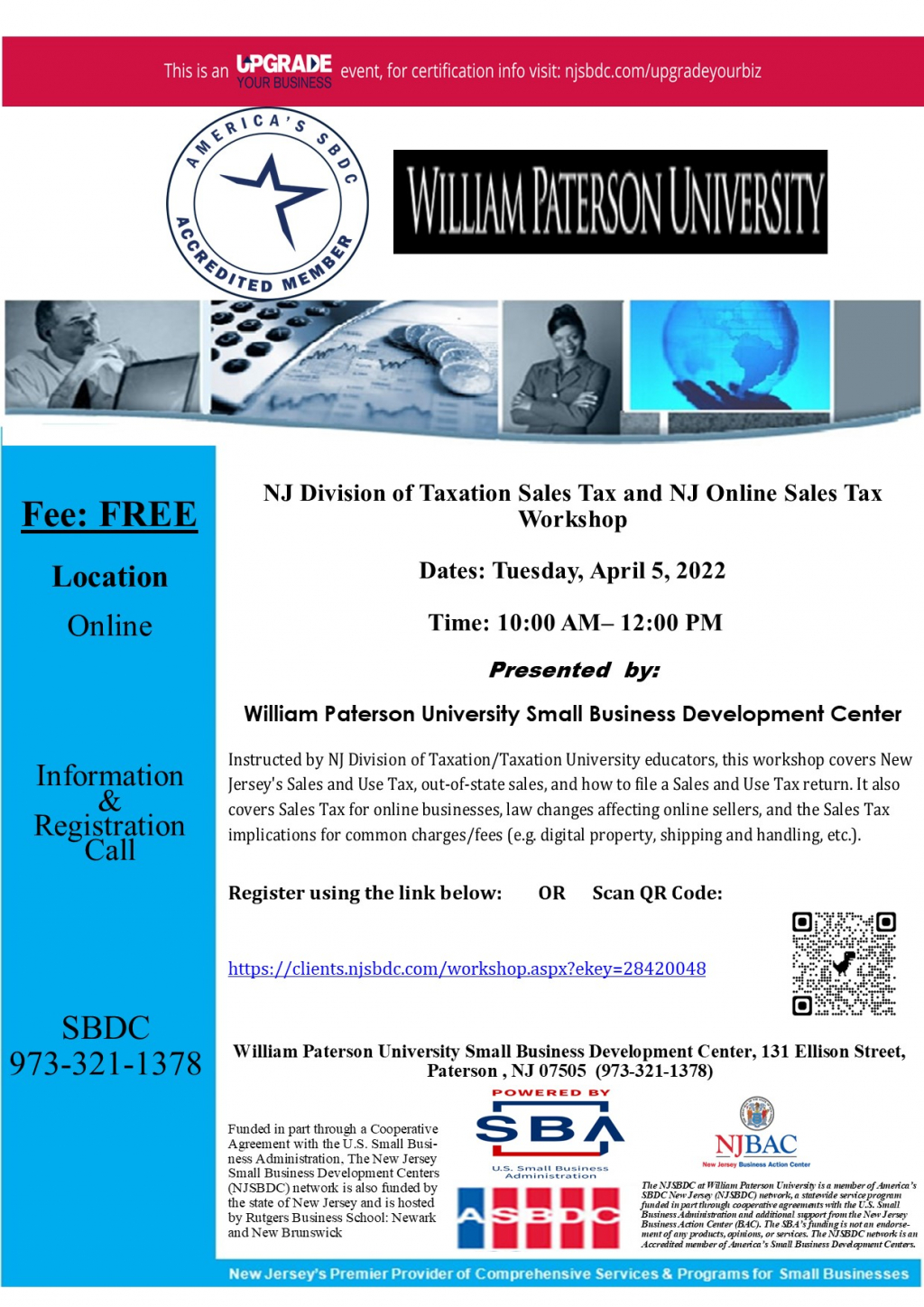

Steps to Help Small Businesses In New Jersey Prepare for the Upcoming Tax Season - Tsamutalis & Company

Jersey City Voters Approve Tax Supporting the Arts, Opening Door for Similar Efforts - Artforum International

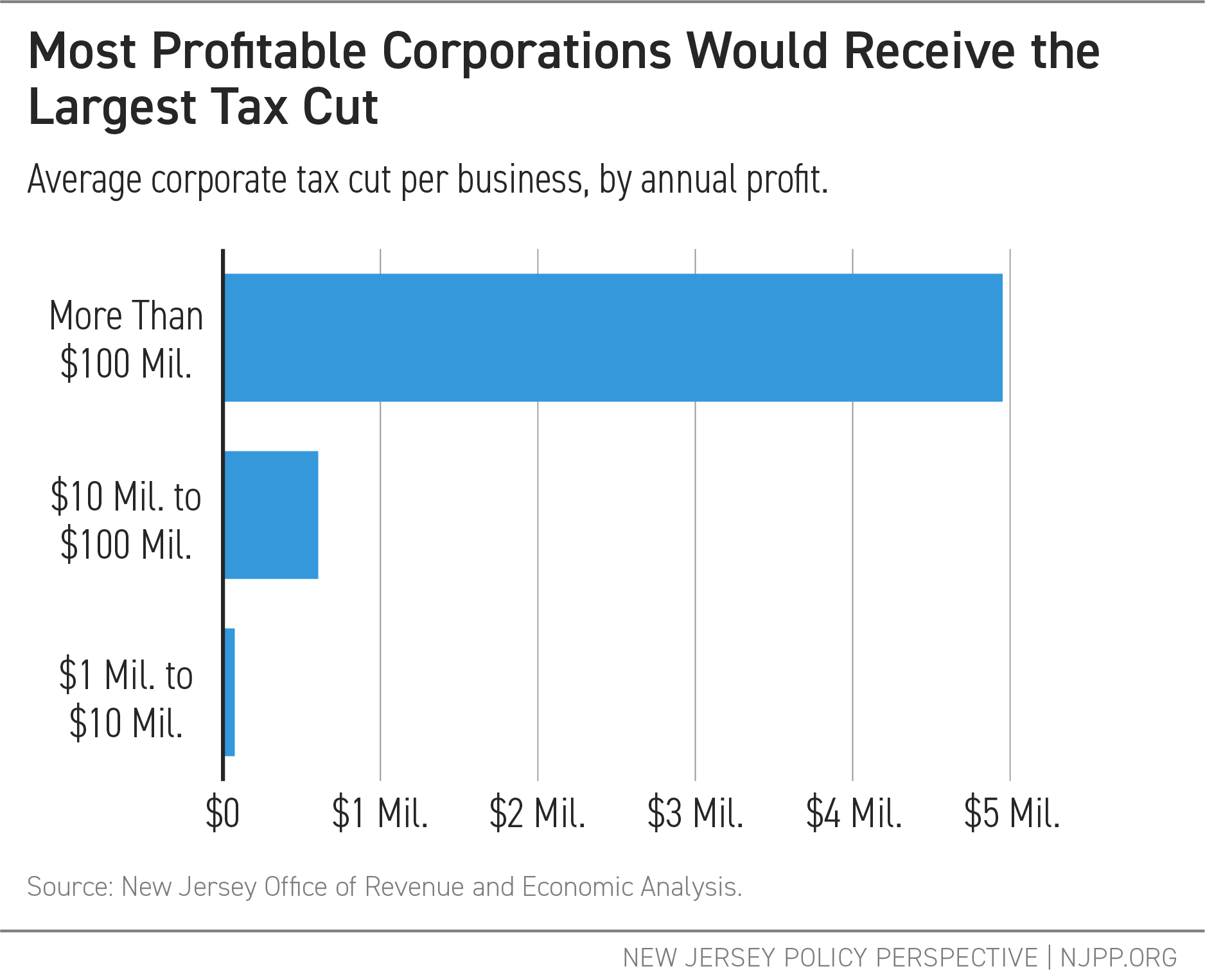

NJBC Urges Gov. Murphy, Lawmakers to Use Federal Funds to Alleviate Massive Tax Increase on Business - NJBIA