How to Calculate Portfolio Risk From Scratch (Examples Included) - Fervent | Finance Courses, Investing Courses

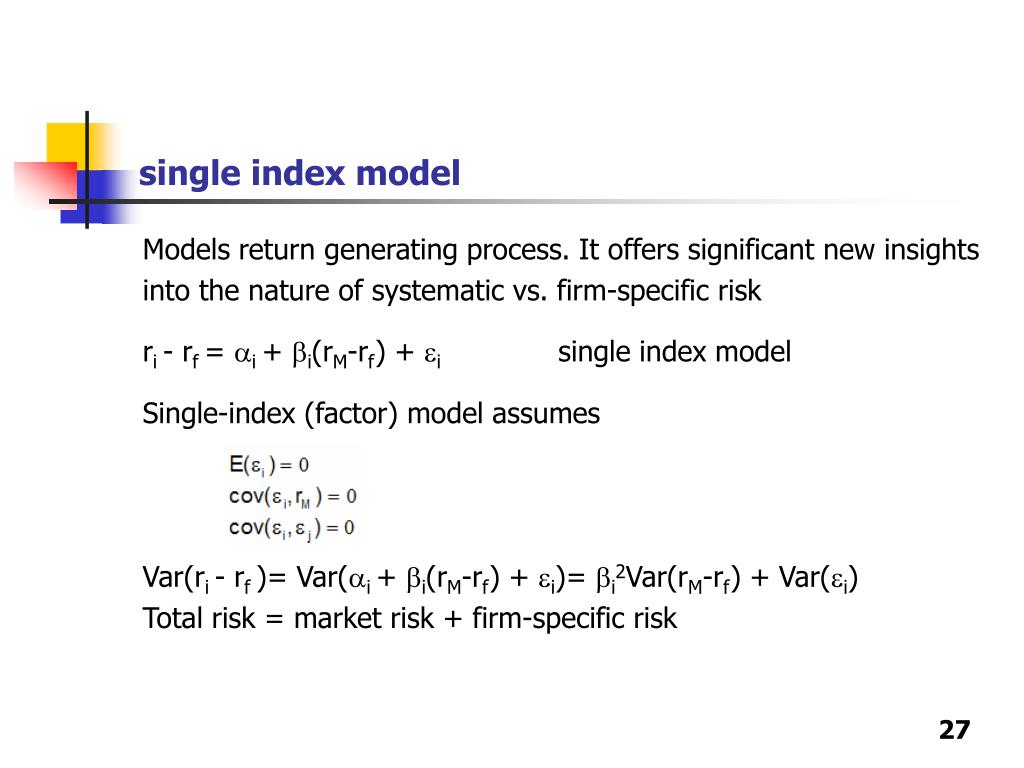

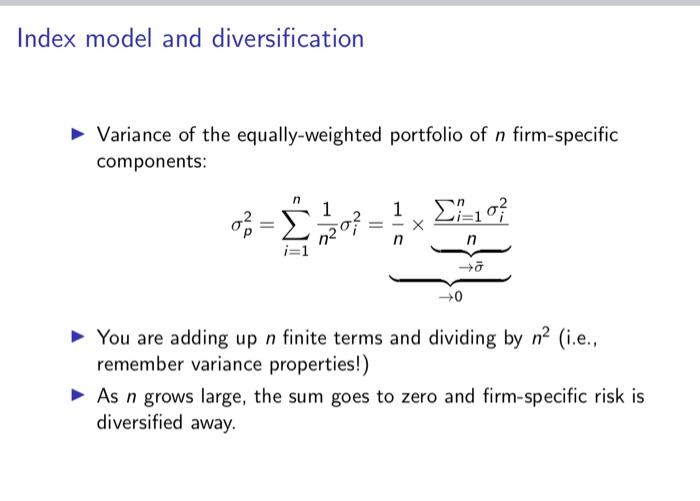

7.1 A SINGLE-FACTOR SECURITY MARKET Input list (portfolio selection) ◦ N estimates of expected returns ◦ N estimates of variance ◦ n(n-1)/2 estimates. - ppt download

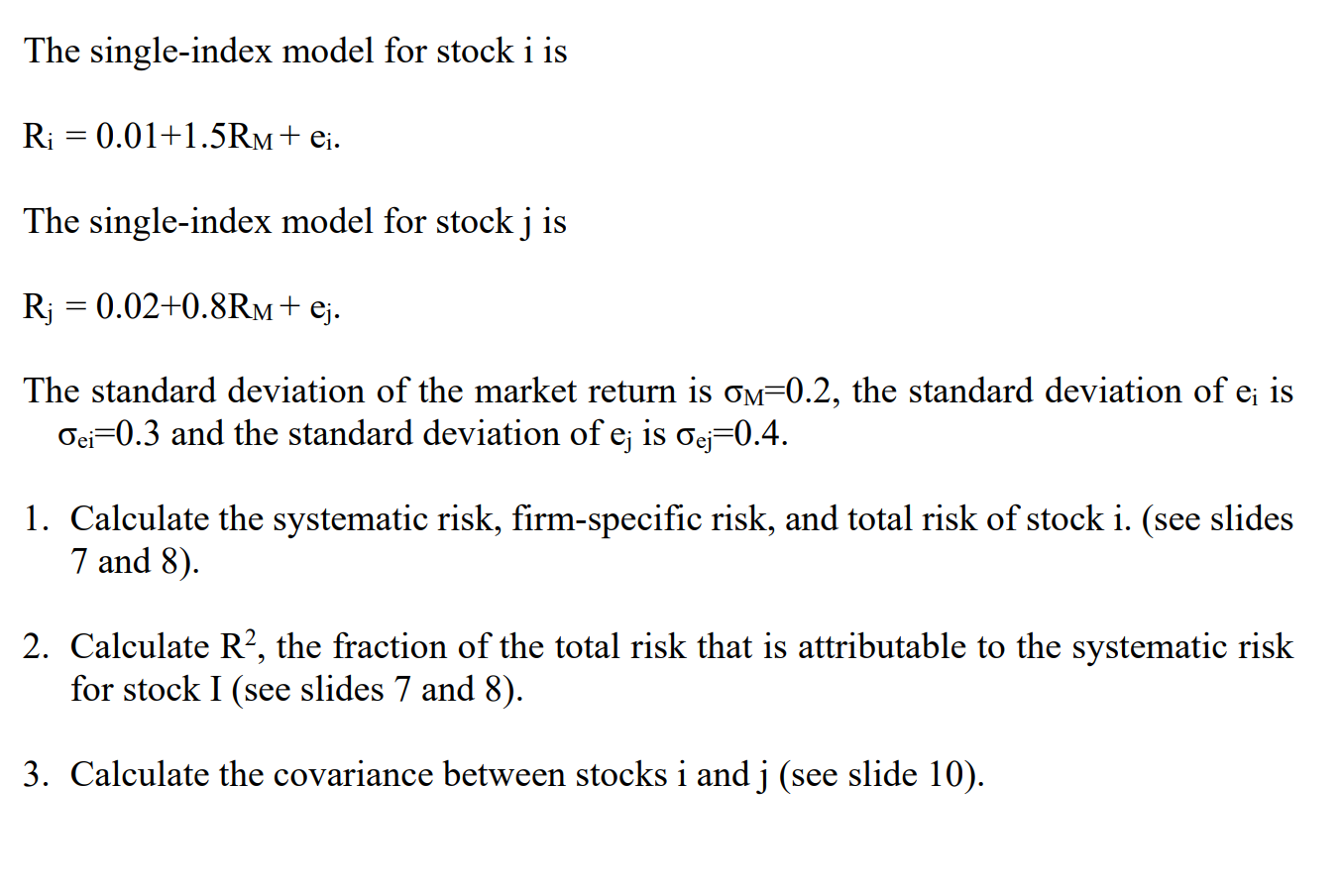

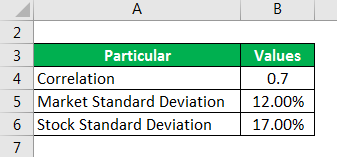

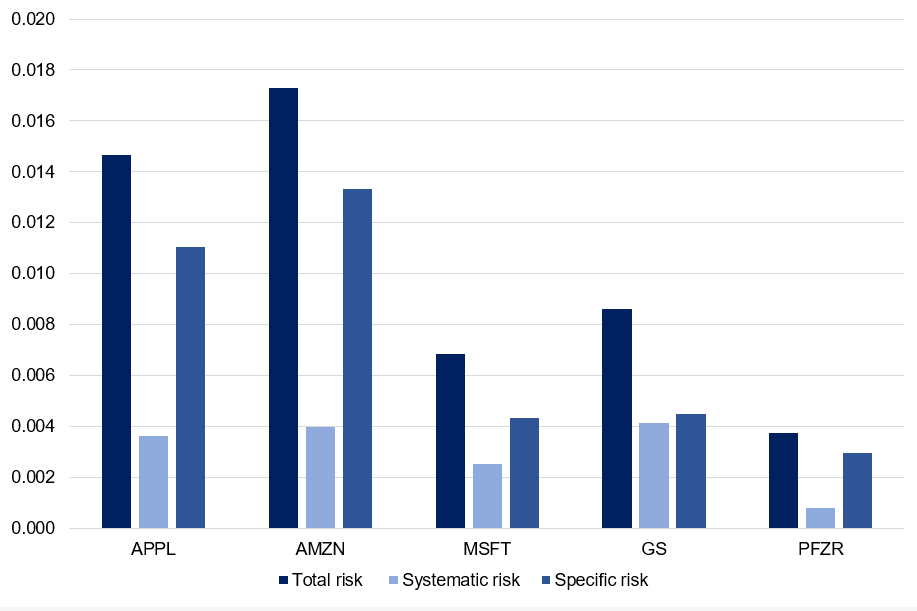

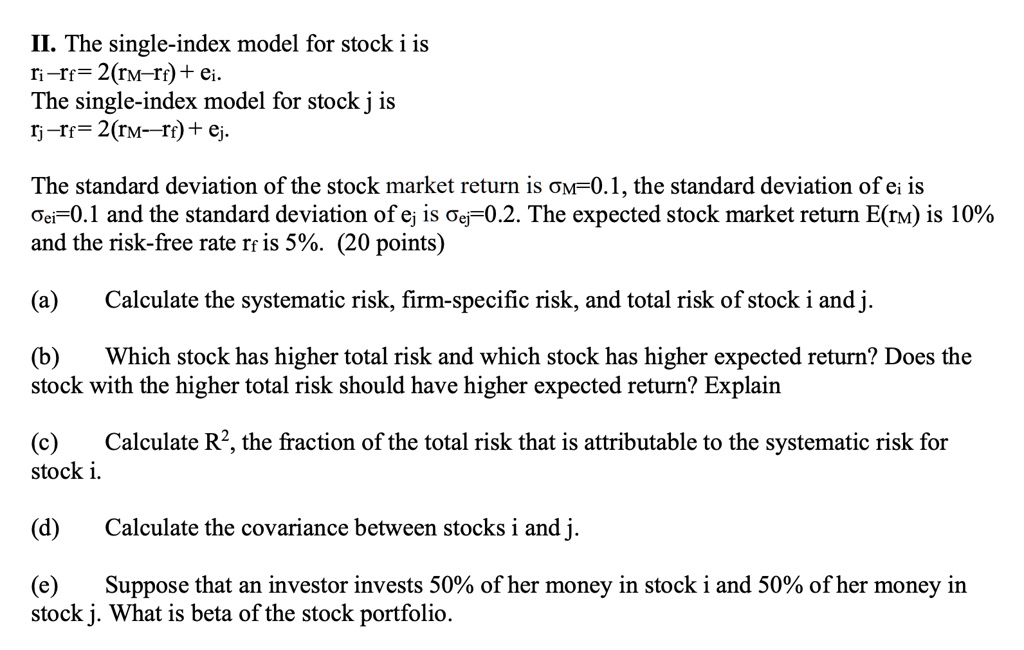

SOLVED: II: The single-index model for stock i is Ii-If== 2(rM-Tf) + ei: The single-index model for stock j is Ij-Tf= 2(rM- Tf) + ej: The standard deviation of the stock market

:max_bytes(150000):strip_icc()/CAPM2-cc8df29f4d814b1597d33eb7742c9243.jpg)