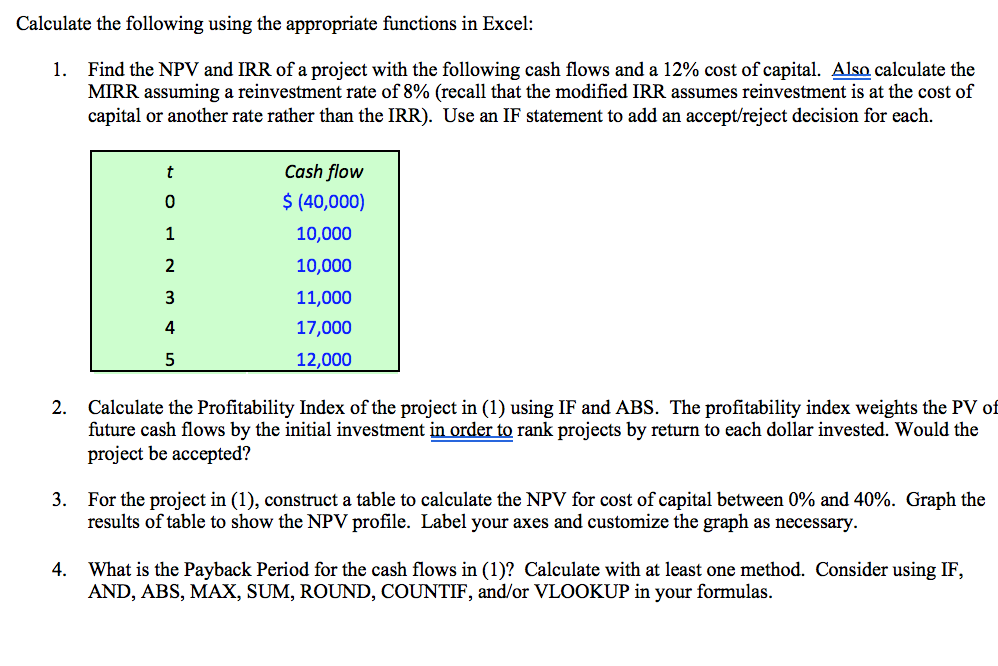

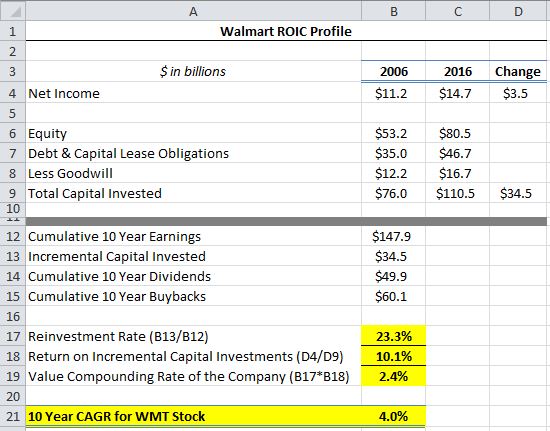

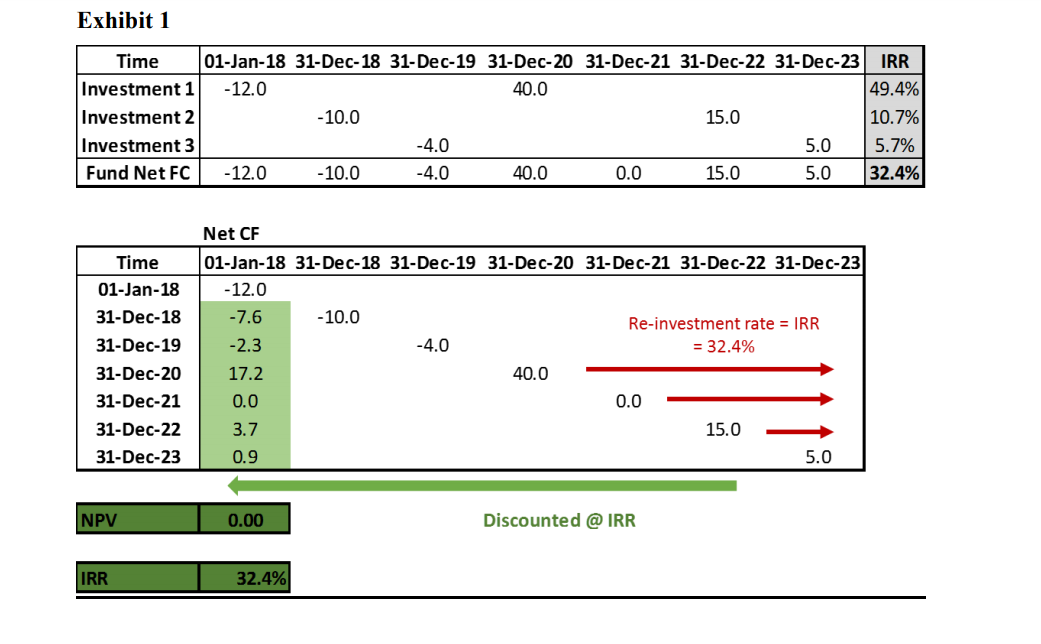

Modified Internal Rate of Return Revisited < Thought | SumProduct are experts in Excel Training: Financial Modelling, Strategic Data Modelling, Model Auditing, Planning & Strategy, Training Courses, Tips & Online Knowledgebase

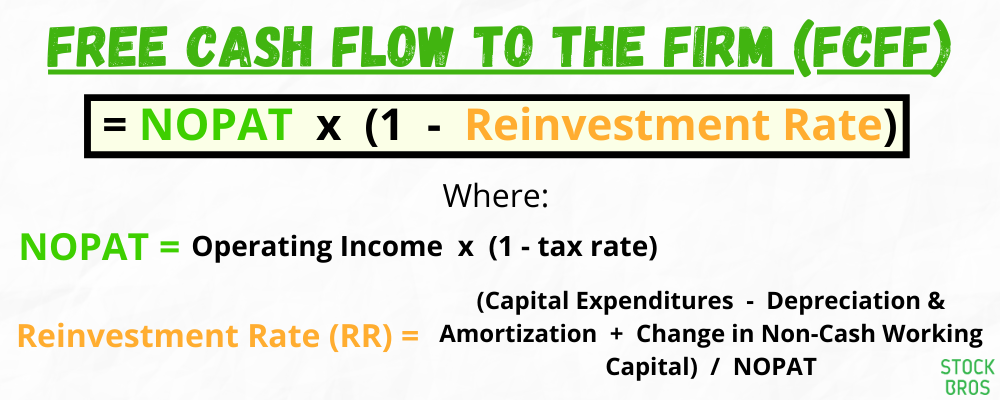

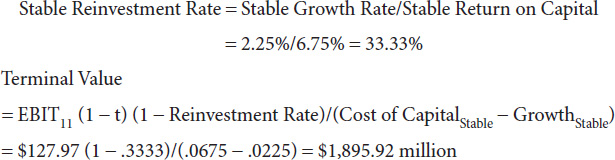

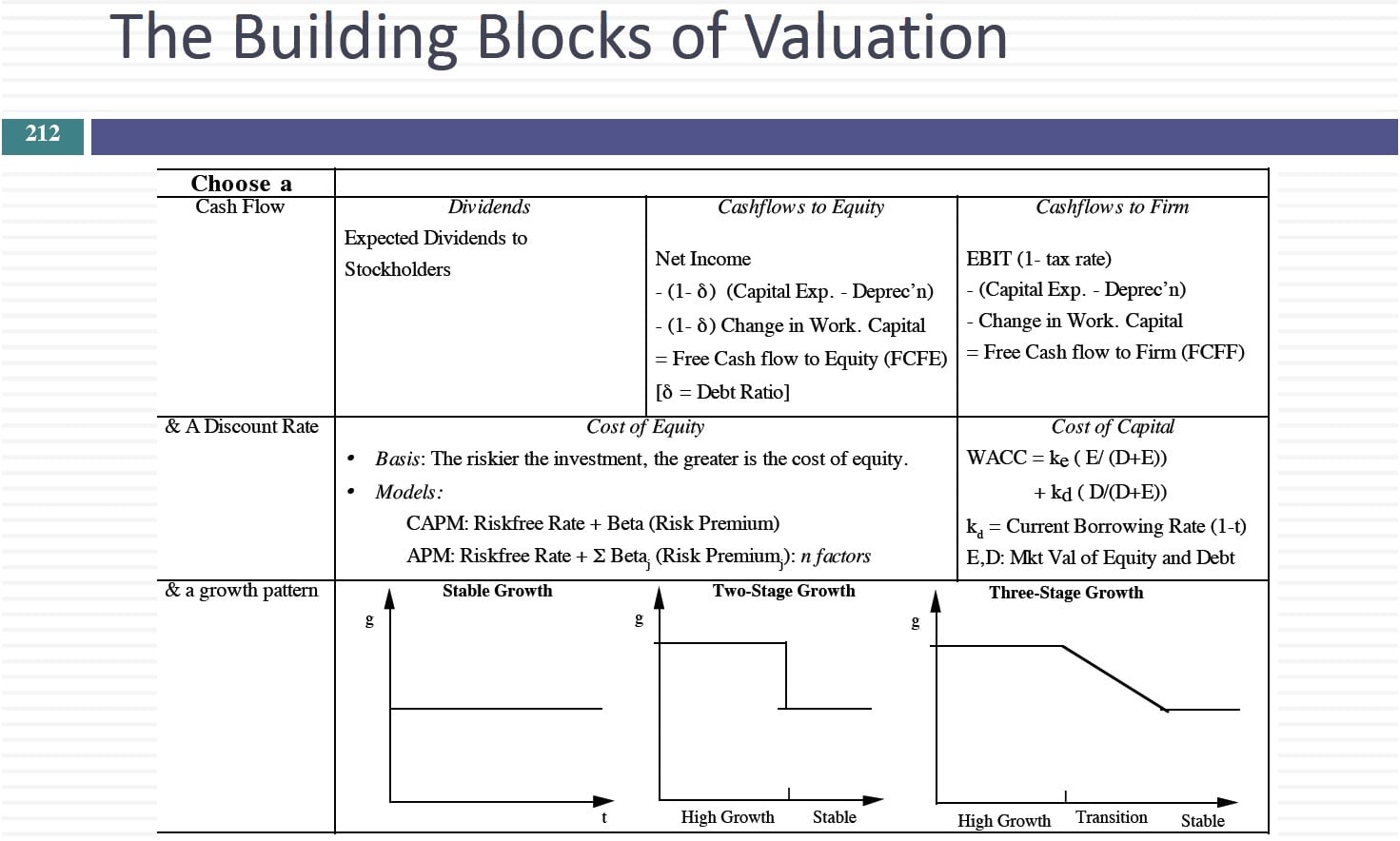

The Ultimate Guide to Advanced Discounted Cash Flow Analysis (DCF) - How to Value a Company - STOCKBROS RESEARCH

![Net Present Value Calculation: Estimating Intrinsic Value [All Steps] - GETMONEYRICH Net Present Value Calculation: Estimating Intrinsic Value [All Steps] - GETMONEYRICH](https://getmoneyrich.com/wp-content/uploads/2010/04/Growth-Rate-FCFF-vs-FCFE-two-Formula.png)